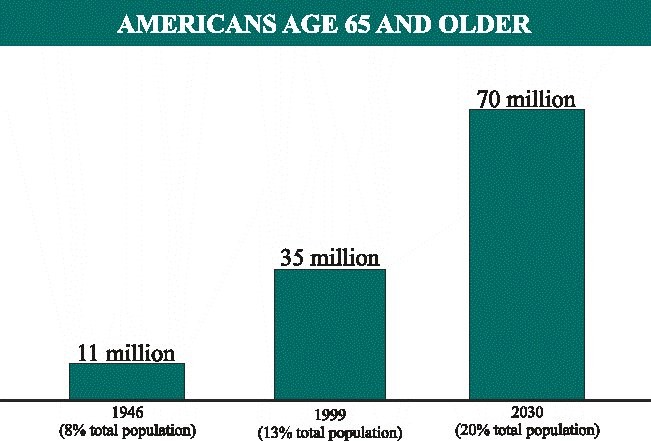

"76 million baby boomers will begin retiring in about 2010, and in about 30 years, there will be nearly twice as many older Americans as there are today. At the same time, the number of workers paying into Social Security per beneficiary will drop from 3.3 to 2. These changes will strain our retirement system.

|

|

"Many people think that their Social Security tax contributions are held in interest-bearing accounts earmarked for their own future retirement needs. Social Security is actually an intergenerational compact—the Social Security taxes paid by today's workers and their employers go mostly to fund benefit payments for today's retirees.

"Social Security is now taking in more in taxes than is paid out in benefits, and the excess funds are credited to Social Security's trust funds. There is now about $896 billion in the trust funds, and they are projected to grow to more than $4 trillion in the next 20 years. But benefit payments will begin to exceed taxes paid in 2015, and the trust funds will be exhausted in 2037. At that time, Social Security will be able to pay only about 72 percent of benefits owed ... if no changes are made."

|

|

**********

Overpopulation: Facts vs. Fears

Evolution: Philosophy masquerading as science?

Beyond the Secular Paradigm

The Story of Philosophy by Will Durant (A Review)

What the pope said about evolution

Homily on the Moral Law

Stem Cell Research: Teaching of Bible & Catholic Church

CRUSADES NONSENSE FROM U.S. NEWS & WORLD REPORT

Stephen Jay Gould: Gorbachev of Darwinism?

Test Tube Offspring Want to Know Father